Income Tax Overview

If you’re employed, you’re getting your T4 slips from your employer at this time of the year. If you’re self-employed, you still have to file your taxes. We have until April 30th here in Canada to be able to file our taxes. So, by the end of February, your employer has to issue a T4 slip, which gives you a breakdown of how much money you earned, how much provincial taxes were withheld, how much federal tax was withheld, and how much your EI insurance premium was. Your Quebec pension plan premium was your QPIP, which is the parental plan, which is one important way that we help Canadians. So, we are contributors to the overall system by paying our taxes. When you get your T4 slip and your pay slip, you notice that taxes are taken off each week or every two weeks, depending on how often you’re paid.

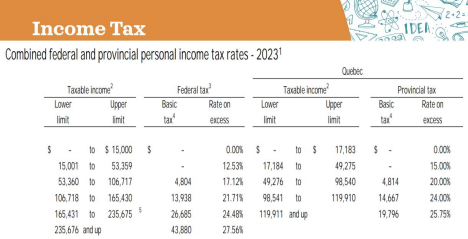

Maybe you are in the second tax bracket and still under $53,000. So, we’re looking at the federal side, where 12.53% of your earnings are paid to Mr. Trudeau and the Canadian governments. On the Quebec side, Quebec is the only province in the country where you have to file two separate tax returns. You have the federal tax return, and you have the provincial tax return. So, the tax rates are a little bit different, but it all works out. So, on the Quebec side, if you’re earning anywhere between 17,184 and 49,275, you’re paying a flat tax of 15% on every single dollar between those. The next tax bracket jumps overall between the federal and the provincial by almost 10%. Let’s say you have $60,000 just for fun. Now you’re going to pay tax on the first $53,000. You’re going to pay 27% up until that point. Now you’re going to pay 37% on the difference. So, from 49,000, if you are making 60,000, there’s $10,824 that you’re going to pay tax on at 37%. It’s not that you’re not paying 37 percent on all of the money. You’re paying tax only on the difference between the first tax bracket and the second tax bracket. So that would give you an average tax rate.

Sometimes, if you have a plan at work that allows you to contribute to an RRSP or a pension plan. The numbers will go down because, by participating in those plans, you’re able to reduce your taxable income. The most important thing to know is that even if you have no income or a low income, it’s really important to file your taxes to be able to access all of the credits available. If you don’t file a tax return, then you’re not eligible to get a GST check every quarter. You’re not eligible for a lot of the programs that are there. So, it’s really important to file your taxes on time, even if you don’t owe anything, because all of these credits are related directly to your tax return.

I arrived last year, in April 2022. Can I file my taxes now this year, in 2023? Or should I do it in the next year for the last two years?

You have to file your taxes this year for last year’s income. So, any income that you earned from the time you arrived in Canada until December 31st is taxable in 2022. So yes, you must file a tax return for this year by April 30th.

I landed in Canada in August, and I started working from November 2022. So, am I also applicable to file the taxes in April 2023?

Yes, you are. Even for the two months that you were working. It’s actually very good; unless you were earning less than what the lowest tax bracket is. So, if you’ve earned less than 15,000 or 17,000 on the Quebec side, you’ve had taxes withheld at source on your paychecks. So, you’ll get everything you paid in income taxes for November and December back if you are underneath those figures. By doing that, all the taxes you paid for the first two months, being in Canada working, you’ll get those taxes back. So it’s very important for you to file your tax return.

Tax Obligations For Individuals

Interest would also be assessed on the money owing. And that compounds So there is no reason for you not to file your taxes. If you don’t have the money to pay your taxes, at least file them and then contact the government by sending a note. Or if you’re using an accountant, send a note saying: “Look, I owe this much; I’m sending you this much.” And then get on a payment plan and plan to pay it off as quickly as you can. However, if you are employed and receive a T4, your Human Resources department is probably doing a good job. If you have underage children, the most important thing is that you’re going to get credits for your children. Meaning you’re going to get the Canadian child tax benefit. There is money available to Canadians of young families in Quebec and Canada that basically helps you support your children by alleviating childcare costs and saving. If you’re able to, put any of these child tax benefits that you do get from the government aside in a savings plan for that child, whether it’s through an RESP or through another savings vehicle that is a lot more flexible than an RESP. It’s very, very important that you earmark that money for the kids and try not to use it for yourselves unless you really, really need to. Because it’s substantial money that could be accumulated for your child. When they do start school, that money could be earmarked for education or used for a down payment on a home. It could be used to help fund their retirement or their wedding. Whatever works for them and for you The most important thing is to put the money aside. It’s not the money that you were used to getting. Put it aside for them, and it’ll accumulate very quickly over time. By the time they are young adults. That’s the most important credit. And the deadline we mentioned is April 30th for individuals. For businesses, it’s actually June. It takes place on June 15th. If you are a business owner, you must file your taxes by June 15th. But if you have a balance owing, I’m going to repeat you still have to pay it by April 30th. There will not be a penalty, but there will be interest that will be added after that date.

Apps For Filing Taxes

One that a lot of my clients use (Clients that do not have difficult taxes, that basically has T4 income, and they don’t have any self-employed income or any real estate properties or anything else) is either TurboTax or the one that most people use, Ufile (This one is directly online). And you basically just enter the information, and it will generate your tax return and file it electronically. So, there’s nothing to print. It’s always good to create a PDF for yourself. If you want to print it, that’s up to you. Most people still prefer to have a paper copy. It is also critical that you create your CLICSEQUR on the Revenue Quebec website as well as your CRA login. If this is the first time filing your taxes in Canada, then these logins will be created after you file your taxes. You will have direct access to your account, so you’ll know all of your limits for future RRSP contributions and TFSA contributions. Let’s say you make $100,000, right? You will probably have to pay around 40% tax on that ($40,000), meaning that your pocket is only going to see $60,000 out of the $100,000. But let’s say you use the RRSP as a tool and you put away $100,000. You decide to do it either through your employer or by opening a plan through us. If you have the room, that’s important. If you put down $30,000, right? Well, you’re not going to pay tax on the $100,000 anymore. You’re only going to pay tax on $70,000. That means you’re going to pay less tax and keep more money in your pocket. So that’s one of the strategies you can use to reduce your tax income. It is also very important to mention that you can contribute this amount until March 1st every year. Usually, it’s the last day of February, but because February 28th falls on the weekend, they’ve given you until Monday, March 1st. Canadian tax law allows RRSP contributions up until March 1st of this year, so it’s important to understand what an RRSP is. It’s basically a registered retirement savings plan. It’s a government program that started many years ago that helps you reduce taxes or defer taxes. The RRSP contribution room is equal to 18% of your earned income from the previous year; so that will accumulate going forward. If you earned, let’s say, $10,000, then $1800 would be your deduction limit for the following year. If you have a pension plan with your employer, this is important. That amount will be reduced by the amounts of your employer’s and your contributions to your pension plans of your employer’s and your contributions to your pension plan. So, I’ll give you an example. If your availability room was only, in this example, $1,800 in the coming year, if you extrapolate the data and you know what you’re going to be able to put in, it’s great. You’re going to be able to put in $1,800 into your pension plan at work plus whatever the following year is going to be, right? So, if you’re going to have 18% of whatever you’re going to earn this year, so in Robinson’s example of $100,000, you’d be able to put $18,000 into your RRSP. Because you’re going to have the room available over there. You would have made the room into the RRSP at that point. So, if you are earning a hundred thousand, then you know you have $18,000 in deduction room. Well, it’s a lot nicer to pay tax on 82,000 than it is on 100,000. So, 40% of your $18,000 will go right back into your pocket

Are there any student benefits when we filed the tax?

Yes, there are. There are student credits. There’s a whole thing on the cost of your education that you’re able to deduct a portion of, and you’re also able to deduct textbooks as well. So, the most important thing is to keep all of your receipts. Depending on where you’re going to school, there is a spot on each school’s website where you’re able to get a breakdown of the cost you paid for your education per course or per semester. So, for example, if the semester ran from September to December for that semester, you could claim whatever you paid during that time. If you are going to school now from January until April, that’s another semester, but that will be for the 2023 tax year. That only has to be filed next year.

Can parents open RRSPs (registered retirement savings plans) for the children and get a tax relief?

The answer is no. You cannot open a registered retirement savings plan for a child. It’s based on, like we had discussed, the 18% of your previous earnings, you’ll get the tax relief, but the children are not. You will not get a tax deduction. You’re not even allowed to open up an RRSP until the child reaches the age of majority, which is 18 in Canada. So, even if, and I wouldn’t recommend it, because if the child is earning less than $15,000 and you want to put money into RRSP, and let’s say they were 19 years old and they’re only earning 12,000, because they’re still students, there’s no benefit. So basically, you’re putting money into an RRSP to save no tax because there’s no tax payable. So, it doesn’t make sense.

Owning government money means that you’re most probably making a very good salary. And at this point, maybe that’s not your case, but that’s what we mean by that. And, when we talk about owning government money, a lot of people are so happy and so excited when they get a check back from the government, but do you know what? The government gave me back $2,000 after I filed my taxes. In reality, what you’re doing is lending the government your money at no interest for a full year, and they’re using that money to build houses, invest, etc. And then at the end of the year they say, “You know what?” I got so much use out of your free money that I’m willing to give you something back. That’s basically what’s happening. So, in reality, what you want to happen is either pay zero so that you balance it out or actually pay the government a little bit, like a hundred or 200, because at that point, if you’re paying the government back, it’s the opposite. It means the government was lending you free money for a year, and you were taking advantage of that. It’s tricky, but that’s the reality. As an example, if you are employed, your employer knows exactly how much you’re doing. Let’s say you know that you’re going to save $10,000 over the course of the year and you’re going to put it into your RRSP. There is a way that we can do it with your employer so that instead of getting a big tax refund at the end of the year, they’re going to withhold less tax throughout the year. As a result, you will receive nothing. But instead of having, as an example, saved $10,000 after tax dollars, your actual cost might have only been $6,500, but you’ve got $10,000 in your RRSP. So that’s another important thing that we can do, and we do it with a lot of clients, which is to maximize your money because 10,000 dollars after taxes is a lot of money. So, if you get $7,000 and have $20,000 working in your RRSP, it’s a big difference.

This is a link to the website for the Quebec government that explain how maternity leave and parental leave work in Quebec. That way, you guys can have an understanding of what benefits are available now. The website will be able to answer all those questions. https://magrossesse.safir.ctip.ssss.gouv.qc.ca/en